Let’s start with the basics, because this is one coverage that’s often misunderstood. Uninsured Motorist, or UM, coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance, or doesn’t have enough insurance, to cover your injuries. Put simply, if someone hits you and can’t pay, UM steps in and pays as if they … Read More

Protect What You Love This Valentine’s Day

Valentine’s Day is a reminder to celebrate the people, homes, and businesses that mean the most to us. While cards and chocolates may show appreciation in the moment, having the right insurance coverage in place is a lasting way to protect what you’ve worked so hard to build. Personal insurance helps safeguard your home, vehicles, and belongings, while commercial insurance … Read More

A New Puppy for Christmas? Don’t Forget the Coverage

A puppy under the Christmas tree is pure magic—full of excitement, new routines, and plenty of joyful chaos. Along with the fun, however, comes an important responsibility that many new pet owners overlook making sure your insurance coverage is properly aligned with your growing family. Most homeowners’ policies include some level of pet liability coverage, but the details matter. Coverage … Read More

ThompsonBaker Agency Gives Back to Betty Griffin Center this season

St. Augustine, FL 11.06.25 – ThompsonBaker Agency is giving back to Betty Griffin Center, a local nonprofit committed to help survivors of domestic and sexual violence navigate through their life-changing traumas to live fulfilling lives on their terms this winter, and encouraging the community to get involved. From now through the end of the year, ThompsonBaker Agency employees will donate … Read More

Flood Advisory, Flood Warning, and Flood Zone: What Do They Mean?

Ever woken up to a relentless downpour, wondering if your street might flood? Floods are a common natural disaster, and being prepared can make a big difference. This guide will explain the key terms: flood advisories, flood warnings, and flood zones. Understanding Flood Risks What is considered a flood? A flood happens when water covers land that’s usually dry, and … Read More

Do I Need Flood Insurance? A Comprehensive Guide to Protecting Your Home

Imagine a cozy night in, when suddenly, heavy rain starts drumming on the roof. What starts as a normal downpour turns into a raging torrent. Floodwaters rise, threatening your home and belongings. This scenario, while frightening, is more common than you might think. Floods can strike anywhere, anytime – even in areas considered low-risk. So, this raises the question,: do … Read More

ThompsonBaker Agency Included In the Big “I”

ThompsonBaker Agency Included In the Big “I” 2021 Best Practices Study St. Augustine, FL, 9/24/2021 – ThompsonBaker Agency continues (FOR THE 9th YEAR) to be part of an elite group of independent insurance agencies around the United States participating in the Independent Insurance Agents & Brokers of America (IIABA or the Big “I”) Best Practices Study Group. The selected Best Practices agencies retain their … Read More

Thousands of Home Insurance Policies Dropped

Other property owners see rates increase ahead of hurricane season. Mark Harper Daytona Beach News-Journal USA TODAY NETWORK This month three carriers of homeowners’ insurance informed state regulators they will be dropping more than 53,000 policies just as hurricane season is arriving. Some Volusia County insurance agents say they’ve been busy – not unlike accountants during tax season – working … Read More

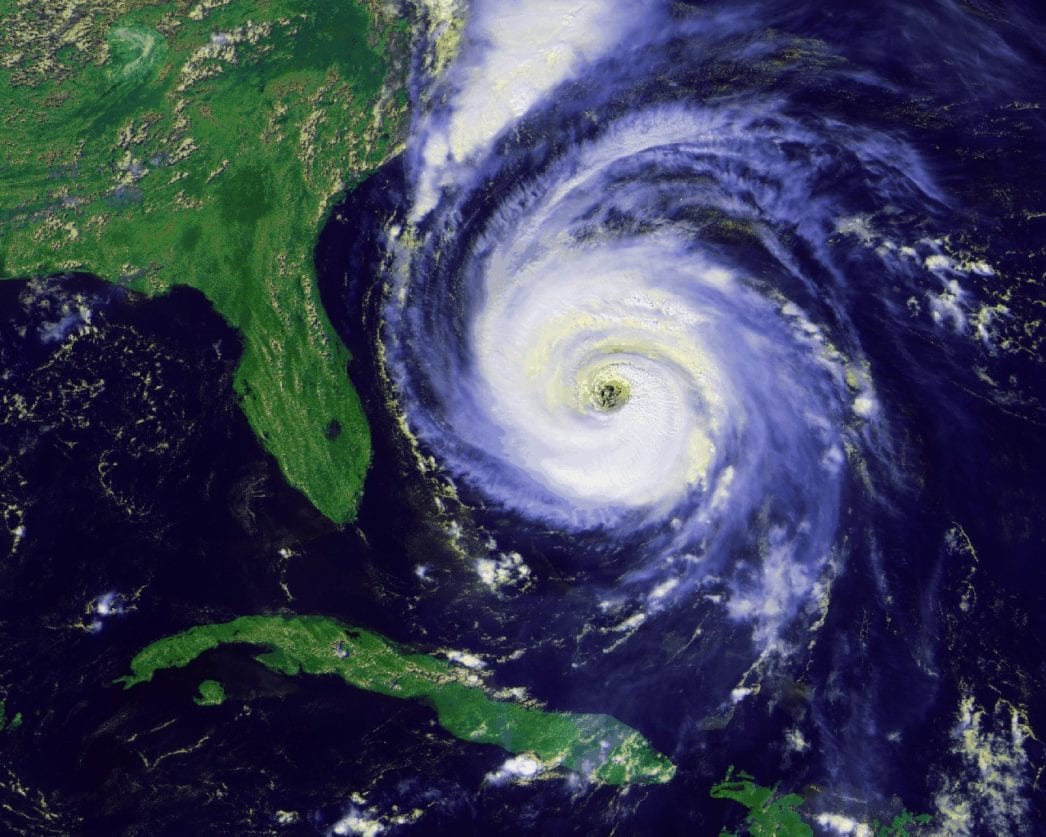

Hurricane Preparedness Guide

Natural Disaster Impact 40% of small businesses will not immediately reopen 25% more small businesses will close one year later 75% of small businesses without a continuity plan will fail 3 years later General Information As of May 20, 2021, NOAA’s is predicting another above-normal Atlantic hurricane season. Forecasters predict a 60% chance of an above-normal season, a 30% … Read More

2021 Legislative Session Update

Introduction: We want to put this information in front of our clients in an effort to keep you informed about the effects in the Florida insurance market related to frivolous lawsuits and to support the legislative efforts to address this below issue. Please take a few minutes to read the email from American Integrity Insurance on lawsuit reform and join … Read More

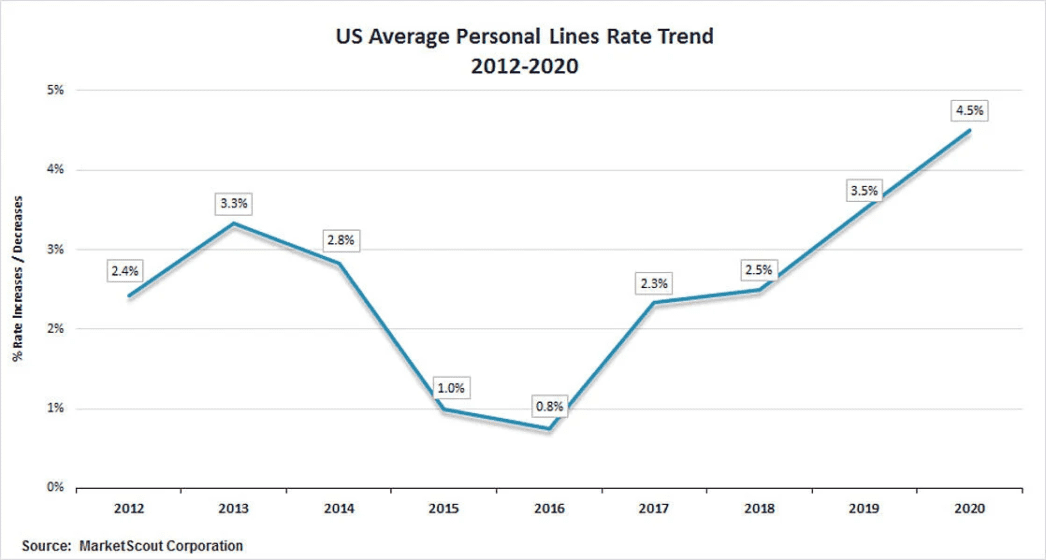

US Personal Lines Rates Up 6.3% in Fourth Quarter 2020

By: MarketScout Large homes assessed biggest rate increase The composite rate for personal lines was up 6.3 percent in the fourth quarter of 2020, reflecting the market’s rate acceleration. In fact, homeowners with properties valued over $1,000,000 paid average rate increases of 8.2 percent clearly signaling ongoing price increases for large homes. Richard Kerr, CEO of MarketScout profiled market conditions … Read More

Florida’s Troubled Property Market: The Problem and Solutions

By Kyle Ulrich Back in September, I blogged about the troubled Florida property market and the second quarter financial results for the domestic homeowners market. Now that third quarter results have been published, it is clear the market is continuing to deteriorate and looks like it will only get worse before it gets better. Again, this is no secret to independent … Read More

Solar Panels

It is becoming more and more common that consumers install solar systems on their homes for the purpose of providing electricity to the home. This is often referred to as “net metering.” While solar panels have been around for a long time, most were used to provide hot water to houses. Solar electric systems are now popular. Under a net … Read More

Celebrate our Veterans!

ThompsonBaker Agency wants to thank everyone who has served in the U.S. Armed Forces. Many clients, friends and family have served and we celebrate them today. Thank you all for your service and time protecting this special country!

Florida Property Insurance Market Inches Closer to Crisis – Part 2

By Amy O’Connor | October 30, 2020 The Florida Office of Insurance Regulation is monitoring the state’s property insurance situation that is seen as in a crisis by those in the industry. The regulator said the insurance market has been buffeted by multiple hurricanes in the last several storm seasons, as well as by other market challenges like assignment of benefits (AOB) abuse, that “have … Read More

Florida Property Insurance Market Inches Closer to Crisis – Part 1

By Amy O’Connor | October 29, 2020 After years of warnings that the Florida property insurance market was heading towards an availability crisis, many in the industry say the moment of reckoning has arrived. They blame unchecked claims litigation from non-catastrophe water losses and rising reinsurance rates that have severely strained the financials of Florida insurers. The situation has gone from bad to … Read More

Weathering the Storm

Throughout our lives, we have to face many storms. Some of these storms are figurative, but often times—especially in Florida—they are literal. When Hurricane Matthew swept through the St. Augustine area last October, ThompsonBaker had to face struggles along with the rest of the community. In our recent video post, President and C.E.O Matt Baker discusses overcoming challenges and serving … Read More

ThompsonBaker Featured in MSA’s 2016 Annual Report

ThompsonBaker was recently featured as one of the first stories in The Main Street America (MSA) Group’s 2016 Annual Report. The article highlights our valuable partnership with Old Dominion, an MSA-affiliated carrier who began working with us more than 30 years ago. Since our partnership started in the 1980s, our companies have worked side-by-side and seen important growth together through the … Read More

City of St. Augustine Receives Important Reimbursement for Safety Measures

ThompsonBaker was recently mentioned in an article for the City of St. Augustine. The city needed to put its public workers through critical safety training, but lacked the necessary funds to put everything together. Without this important training, public works staff and rescue personnel could find themselves in serious danger when it comes to both daily work and rescue operations. … Read More

Congratulations to Kristin Hurst, our 2nd Quarter production leader!

Thank you Kristin for your dedication & hard work! Such a pleasure working with a professional group of agents. We presented Kristin the award at our Quarterly Employee Dinner at Caps Restaurant.

ThompsonBaker Agency is celebrating 91 years serving St. Augustine, please check out the article in Old City Life Magazine.

ThompsonBaker Agency has recently been featured in Old City Life Magazine. The article, titled “A History of Excellence” describes ThompsonBaker’s humble beginnings as a St. Augustine-based agency that has remained loyal to its clients and the community for over 90 years. The magazine occasionally writes features on businesses they know are experienced and trustworthy, and chose to feature our company in … Read More

Kellie Brandes Awarded 2016 Florida Outstanding Customer Service Representative

Congratulations to our very own Kellie Brandes for winning the 2016 Florida Outstanding Customer Service Representative of the Year! To qualify for the top state honor, Kellie submitted an essay on how she came into the insurance industry and what four reason she stayed and built a career. Through her contributions to our agency, the industry, the clients and community, … Read More

Be Prepared for Hurricane Season – Download our Free Guide!

Hurricane Season officially starts on June 1st. Make sure you are prepared with our free Hurricane Preparedness guide available below. Download the 2016 Hurricane Guide

Congratulations to Alan Bratic & Kathy Currington

Congratulations on their Best of St. Augustine 2015 recognition. Alan won 1st place for Best Financial Planner and Kathy, runner up for Best Life & Health Insurance Agent. Way to go you two! This is the second year running they’ve been awarded these honors.

Congratulations to our Chairman, Greg Baker!

Congratulations to our Chairman, Greg Baker, who was awarded the Florida Association of Insurance Agents (FAIA) Chairman’s Award. This award derived from, among many other things, his work and leadership in workforce development and in being the main person responsible for getting insurance education programs started in what will soon be 6 state colleges in Florida. Greg was honored in … Read More

Congratulations Davis Alexander

Congratulations Davis Alexander, on becoming the first student to receive a 20-44 insurance license (on the same day the law took effect) under the new law created by HB 1133. We are so proud to have you as part of our team! To learn more about the bill, please visit https://www.flsenate.gov/Committe…/BillSummaries/…/html/1097

Our VP, Dan Alexander, was recently elected to the Board of Directors for the Florida Association of Insurance Agents (FAIA).

Our VP, Dan Alexander, was recently elected to the Board of Directors for the Florida Association of Insurance Agents (FAIA). FAIA is dedicated to enhancing the independent agency system through education, legislation, communication and member service. FAIA is the central source of information for 2,200 member agencies throughout the state, which employs over 25,000 licensed agents. Dan just entered his … Read More

06.2013

On June 22, 2013 Gregory E. Baker received The Mitchell Stallings Memorial Award in recognition of his continuing service to FAIA, to the insurance industry, and to the community. View the pdf

04.2013

On April 6, 2013, ThompsonBaker Agency will sponsor Kiwanis One Day Walk-A-Thon as part of the Eliminate Project. The Eliminate Project is Kiwanis International’s global campaign to help eliminate maternal and neonatal tetanus from the face of the Earth. The campaign will raise $110 million for the project.

03.2013

Dan Alexander was welcomed as Chairman of The St. Augustine Chamber of Commerce during the annual breakfast. The Chamber announced its resolution to unify the St. Johns County business community by merging the St. Johns County Chamber of Commerce and the Ponte Vedra Beach Chamber of Commerce.

10.2012

Congratulations to our Personal Line Team Leader, Matt Cornelison, who was recently awarded Travelers High Achiever of the Year award for the Northeast Florida territory! The High Achiever Award is based on the individuals Experience, Professional Development, Product Knowledge, Quality of Work, Client Service and Team Dynamics. Congratulations again Matt!

08.2012

Congratulations to our very own Matt Cornelison for graduating from the Chamber’s Leadership St. John’s Class of 2012. “I was truly excited to participate in the program, but was not sure how much I would get out of it,” suggests 2012 graduate Matt Cornelison, of the Thompson Baker Agency. “After meeting the other class members and people in our community, … Read More

05.2012

Download our 2012 Hurricane Preparedness Guide and get ready for hurricane season, June 1st – November 30th. Do you know why we recommend and sell flood insurance? Check out these Before & After photos from Hurricane Katrina.

01.2012

Alan recently spoke at the Economic Development Council’s quarterly breakfast. Read about it here.

08.2011

Please help us welcome our newest intern Charlsea Owens. Charlsea will primarily be working with our Personal Insurance department, but will also perform other duties for the Agency. She is a Senior at Flagler College and is majoring in Business. She is also Captain on the Flagler College Women’s Basketball Team.

06.2011

Download our 2011 Hurricane Preparedness Guide and get ready for hurrricane season, June 1st – November 30th.

05.2011

Please help us welcome Dillon Cunningham as our new intern. Dillon is performing the duties of Commercial Lines Account Administrator. He is currently enrolled at St. Johns River State College pursuing a Business degree. We feel confident that Dillon will be an asset to the Agency. This internship program is another way that ThompsonBaker is moving forward with recruitment of … Read More